Home > Insights > Press Releases > Toying with tradition: Nostalgic kidults fuel £1bn surge as UK gears up for record Christmas sales

BRACKNELL, UK – 13 November 2024 – Despite a year marked by economic uncertainty, toy sales are being given a boost this year by a growing number of nostalgic “kidults” – individuals aged 12 and older. This latest data from Circana, a leading advisor on the complexity of consumer behaviour, reports that while overall toy sales declined slightly in 2024 compared to the previous year, kidults are behind the record-breaking £1bn in sales over the past twelve months, accounting for nearly one in every three pounds spent on toys in the UK, up £57m in 2023.

Biggest growth categories this year and the rise and rise of the kidult

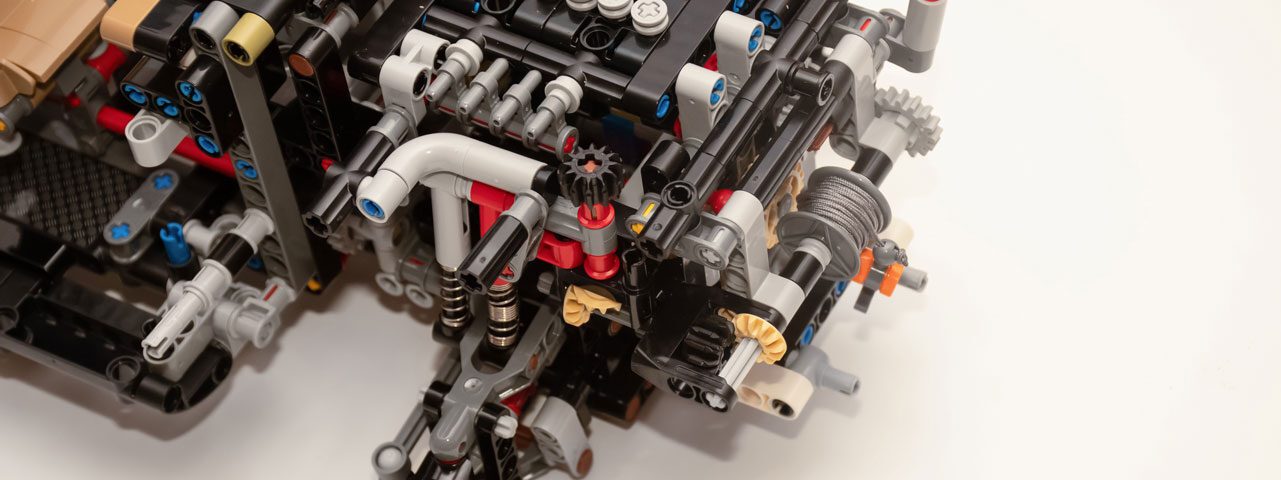

Circana revealed that the biggest growth categories include building sets, traditional plush and collectible cards and stickers which appeal to all age groups. However strong growth has been observed in toys purchased for adults and teens. Sales to these kidults has grown +8% and now accounts for nearly £1 in every £3 spent on toys this year, equating to £1bn in the last 12 months (to end September).

The growth in collectibles is noteworthy and spans all toy categories as part of series or range. They now account for 23% of toys sold (by volume) with an average selling price £6.92 which is an affordable purchase for pocket money purchases as well as adult impulse purchases.

Melissa Symonds, UK Toys Director for Circana says: “By tapping into the joy economy, toys are increasingly being recognised for their positive mental health benefits as they spark nostalgia and bring escapism from global turmoil into consumers’ lives. The kidult trend, alongside an emphasis on collectibles, continues to transform the UK’s toy market, affirming toys’ enduring appeal across generations.”

Promotions matter

While last minute purchases can be partly driven by Christmas timing, it can also be explained by shoppers looking for promotions. The UK has the highest level of promotion on toys across Europe, accounting for 35% of all toy sales in 2023, significantly higher than Europe’s 24% average.

For savvy toy shoppers, the festive frenzy starts in the final week of November when Black Friday and Cyber Monday offers coincide with many consumers’ final pay before Christmas.

“It’s all go, go, go – and ho, ho, ho as the final quarter progresses,” comments Symonds. “It is the biggest time of the year for UK toy sales – with December alone accounting for 21% of annual toy sales, the equivalent of January to April sales combined.

“Retailers and brands in retail are becoming increasingly reliant on a strong final quarter of the year with many starting their Christmas campaigns earlier to avoid ‘holiday fatigue’. With December 25th falling on a Wednesday this year, retailers will be hoping for a late shopping surge – which we last saw in 2019. The extra shopping days could significantly determine the overall performance of the UK toy market, which has shown improvement over previous years, down just 3% this year compared to -4% in 2023 and -5% in 2022.”

Eureka Communications

Tel: +44 (0)1420 564346

Mob: +44 (0)7990 520390

Global Industry Advisor

Email: frederique.tutt@circana.com

Phone: +33 630446824