Mom always takes center stage, but this year, there is a different kind of spotlight on her when it comes to retail activity.

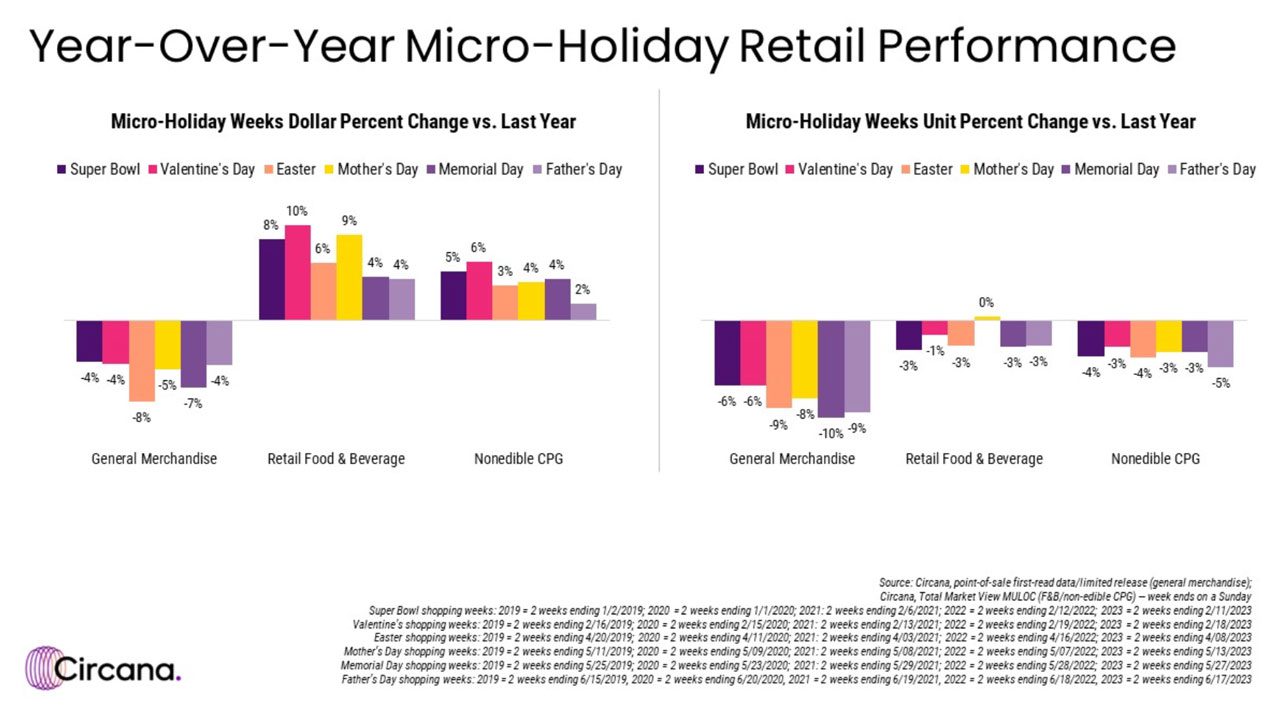

Discretionary general merchandise retail sales have been averaging 4-5% behind last year’s performance almost every week. Retail food and beverage sales are running an average of 2% higher than they were last year, and nonedible CPG sales are up about 1% each week. These sales trends put a lot of pressure on mini-retail holidays, like Mother’s Day, to perform. So far this year, general merchandise has taken a hit to sales revenue over each of these critical retail opportunities, which have fallen short on demand across all of retail.

Last year, almost half of Mother’s Day gift-givers planned on giving Mom flowers or sweets, while 20% had their sights set on the gift of an experience, like a trip to the spa, dining out or tickets to an event. Fewer consumers planned on giving gifts like fragrance, apparel and fashion accessories. Given the elevated cost associated with dining out, there is a chance that gifting and dining at home will garner some added attention, but it’s not likely to be enough to drive gains overall. Top categories – from flowers to fragrance, slippers to sleepwear and jewelry to a Jaguar (or other appropriately fancy gifts) – as well as practical ones, will gain some traction, but they will once again be competing with experiential gifts for Mom.

If Mother’s Day follows the mini-holiday retail trend that preceded, it should be a sign to marketers that something significant must change in order to get the consumer’s attention, and get back to retail growth.

It won’t be the usual Mother’s Day – Mom will not be forgotten, but it may feel like it at retail.

Get insights straight to your inbox