By Jonna Parker, Team Lead, Fresh Foods Group

As the pandemic faded into the rearview mirror and U.S. consumers grappled with two years of historic inflation, 2024 was to be the year grocery retailers and manufacturers got back to normal. But the summer and early fall brought disruptive events in the form of headline-dominating food safety issues and the threat of a dock workers’ strike. An issue with deli meat left cases empty in some of the highest-volume U.S. retail chains in late July, and news of the pending strike in October led people to hoard toilet paper. Significant supply chain disruptions – whether caused by a strike, a recall, or a viral video-induced influx of consumer demand – can happen at any time to anyone in the retail food industry.

While it’s impossible to be fully prepared for these kinds of disruptions, there three strategies manufacturers and retailers can use during a disruption to help them move from a reactive posture to a proactive one.

Strategy #1: Look at the most current and detailed market sales data for the affected period.

We always recommend manufacturers monitor their volume data on a weekly basis, rather than waiting for slow, high-level monthly or quarterly updates. When major supply chain disruptions occur, organizations need access to the latest granular data about market dynamics. Point-of-sale data is now available eight days after period close, even in fresh and random-weight categories. During a period of unprecedented disruption, upgrading to weekly data deliveries can help organizations act faster and minimize guesswork about where and how consumers respond.

Strategy #2: Categorize your shopper types and understand how they impact your products’ volume.

How does your product’s volume change based on different types of shoppers, such as new, lost, retained, and whether they are heavy, medium, or light users?

It’s critically important for manufacturers to understand what’s happening to their volume – including knowing their products’ heavy, medium, and light consumers – before and after a disruptive event. Understanding how much volume each consumer type drives will be a clue about how fast (and how difficult) it will be to recover.

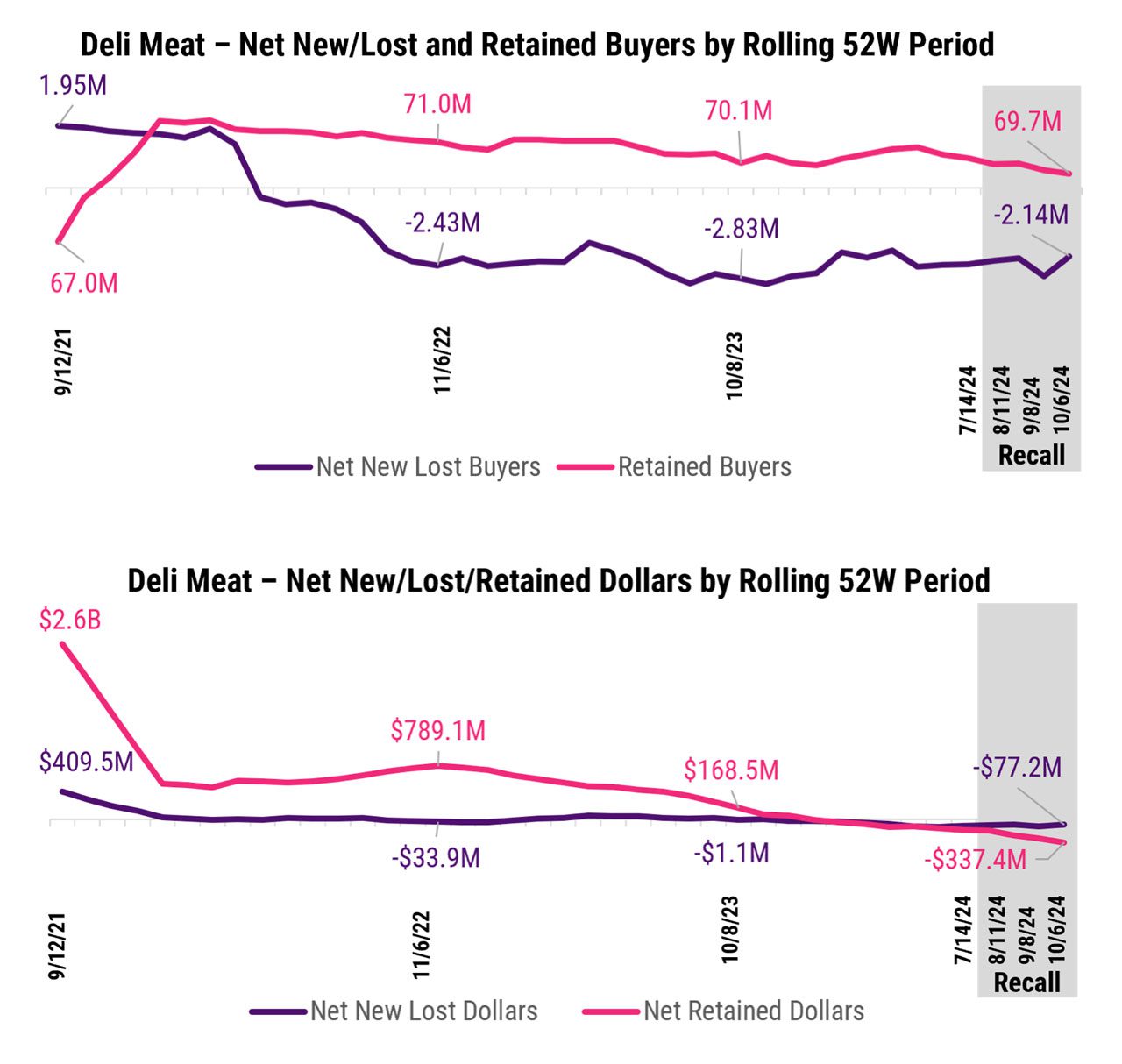

For example, in the spring and summer preceding the U.S. deli meat disruption, the service deli industry was already trending lower in pounds and dollar sales versus the prior year. At the time, few realized more shoppers were leaving deli meat than were entering the category.

Diagnosing the category’s retention and buy rate problem prior to the emergency of food safety concerns signaled that recovering to pre-disruption pounds would take more than just getting product back on shelf. It will require a longer-term effort to earn back the heaviest buyers’ trust and assure them the category still offers value.

Source: Circana, Integrated Fresh Scan Panel, 9/12/21-10/6/24

Strategy #3: Consider how grocery supply chain disruptions are impacting other products.

Disruptions to demand don’t just affect the item at the center – they also affect companion items and behaviors related to how that item is consumed or used. Brands shouldn’t assume they know with what other products their consumers use their product, what else they buy in the same basket, or products for which they are substituting. Instead, they should review co-purchase and switching data before, during, and after an event to update their knowledge of their own products.

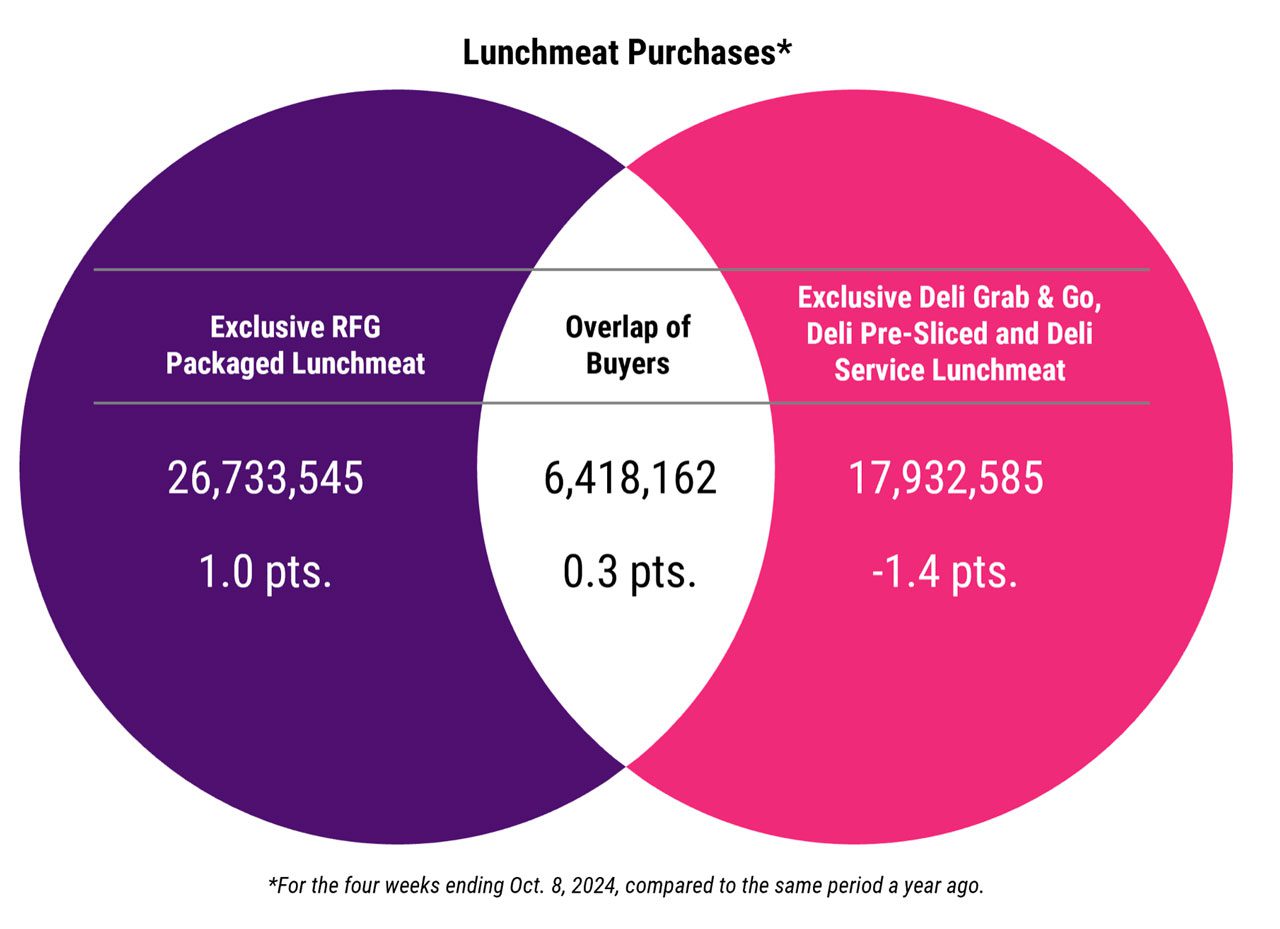

For example, many thought deli’s loss would be a gain for packaged lunchmeat in the meat department, but at Circana, we knew very few packaged lunchmeat buyers also buy deli meat. The two spaces have very little overlap in the same trip and retailer. When deli meat was disrupted, it might’ve been easy to assume consumers would view these products interchangeably, but behavior and switching data told a different story.

Source: Circana, Integrated Fresh Scan Panel, for the 4 weeks ending Oct. 8, 2024 vs. a year ago

When a major disruption impacts a category or a retailer, many organizations opt to just weather the storm and adjust their strategies as events unfold. But organizations that proactively monitor their new, lost, and retained consumers, their volume data, and consumer switching behaviors can respond quicker and, in some cases, recover their costs.

Do you have any questions for Circana? Email GrowthInsights@circana.com.

Want to be prepared for the next disruption? Consider Circana’s Liquid Data Go™ to bring the power of big data insights to any size company or budget. Request your free trial today!

Get insights straight to your inbox